by smsfoptions | Mon, Aug, 2014 | Adviser, Artwork & Collectables, Borrowing, Equities, Investments, Property, SMSF Options, Tips and traps, Trustee

Whenever there is a discussion on Self-Managed Super nowadays, at some point the topic of cost will work its way into the conversation. Should I setup a SMSF – what will it cost compared to a public fund, how much will it cost to setup, how much will it cost to...

by smsfoptions | Fri, Jul, 2014 | Boosting your Balance, Borrowing, Property, SMSF Options, Tips and traps, Trustee

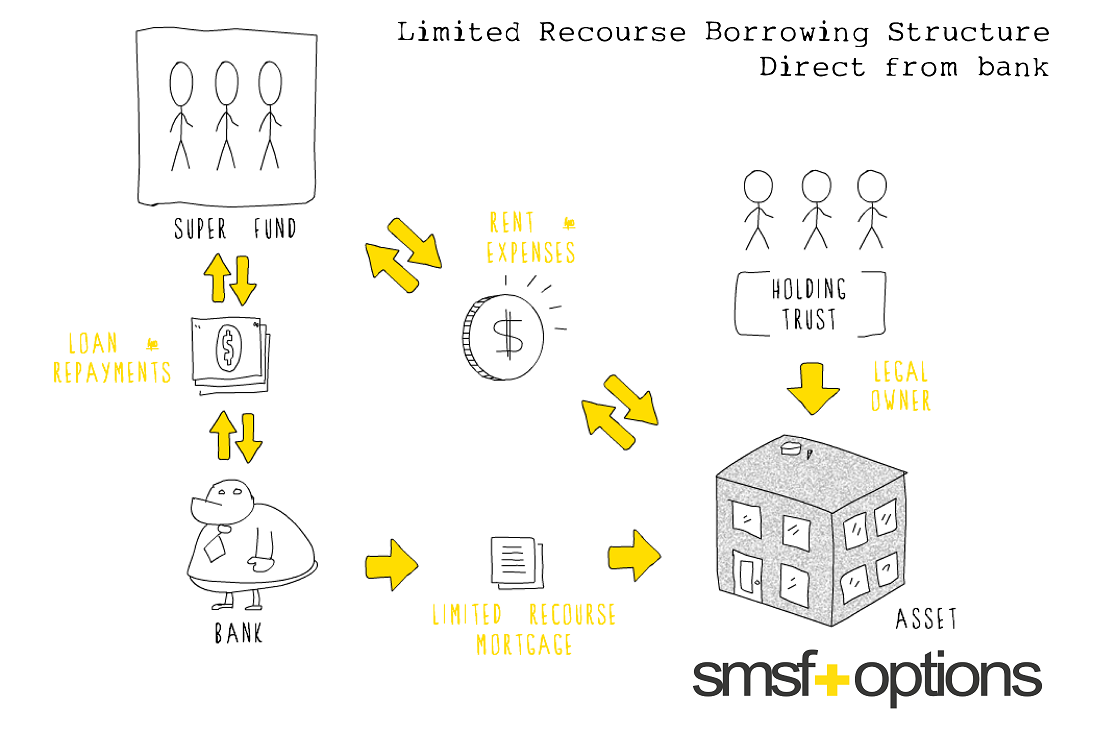

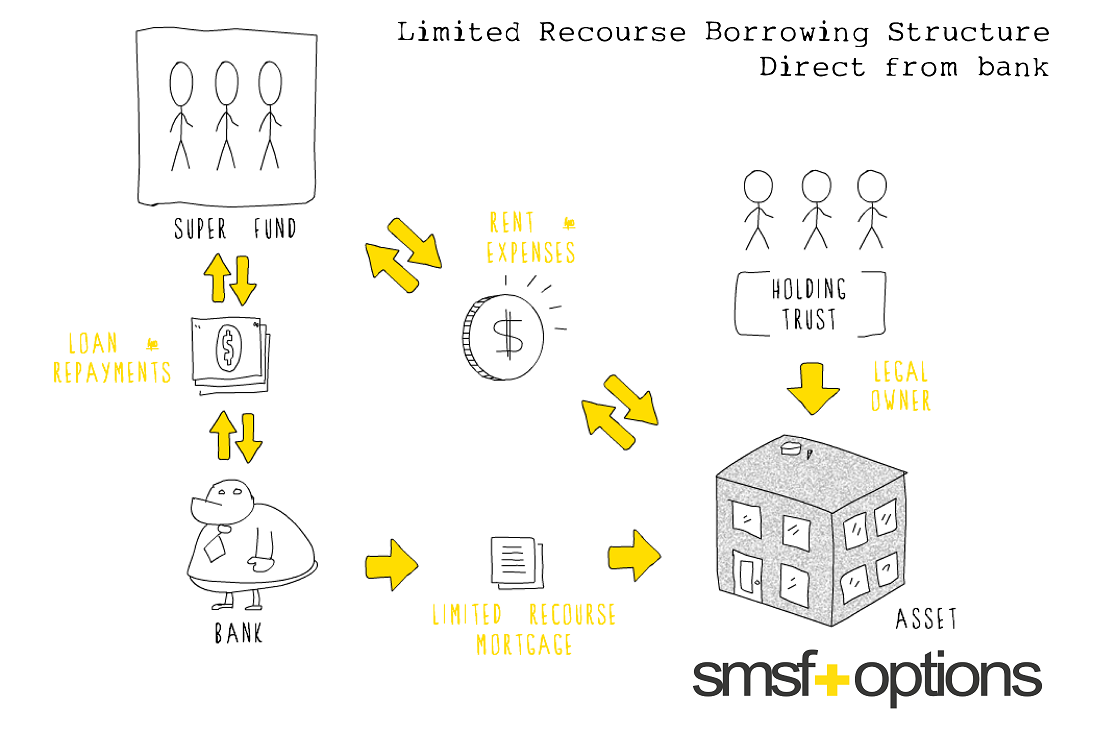

Although Self-Managed Superannuation Funds (SMSFs) are normally not allowed to borrow, there are some important exceptions to this rule. One such exception, which has received plenty of attention in recent times, is an “Limited Recourse Borrowing Arrangements” (LRBA),...

by smsfoptions | Mon, Jun, 2014 | SMSF News, SMSF Options, Tips and traps, Trustee

The ATO has introduced new penalty powers which it can impose on you if your fund breaks certain superannuation rules. The new rules apply from 1 July this year and allow the ATO to fine you and require you to rectify the mistake that has been made. They can also...

by smsfoptions | Thu, May, 2014 | Accessing your super, Adviser, Boosting your Balance, Investments, SMSF News, SMSF Options, Tips and traps, Trustee

Refunds of excess non-concessional contributions, changes to the Super Guarantee and tighter rules on qualifying social security benefits were the main Budget announcements to impact on superannuation this year. These changes, along with others, should provide a...

by smsfoptions | Tue, Nov, 2013 | Adviser, SMSF News, SMSF Options, Trustee

On Wednesday 6 November 2013, the Treasurer, the Hon Joe Hockey MP, and the Assistant Treasurer, Senator the Hon Arthur Sinodinos AO, announced the Government’s decision to abandon some of the previous Government’s tax and superannuation proposals. The announcement...