by Guy Wuoti | Fri, Apr, 2020 | SMSF Gold Coast, Borrowing, Property, Tips and traps

The economic impacts of the COVID-19 crisis are causing significant financial distress for many businesses and individuals. If your SMSF has a related party loan and is impacted due to the financial effects of COVID-19, you may be able to provide your LRBA with relief...

by Guy Wuoti | Mon, Sep, 2014 | Adviser, Boosting your Balance, Borrowing, Investments, Property, SMSF Options, Tips and traps, Trustee

It’s a common question. I would like to purchase property in my super fund; however my fund does not have sufficient money to finance the property. Are there any alternatives to borrowing in super? The simple answer is yes. While the merits of each alternative is...

by Guy Wuoti | Thu, Aug, 2014 | Accessing your super, Adviser, Boosting your Balance, Borrowing, Contributions, Equities, Investments, Pensions, Property, SMSF Options, Trustee

There is nothing more exiting than waking up by the pool while on holidays, than checking out your super fund’s investments to see how they are going. Okay maybe not that exciting for most, but the great news you could do this if you wanted to, no matter the...

by smsfoptions | Mon, Aug, 2014 | Adviser, Artwork & Collectables, Borrowing, Equities, Investments, Property, SMSF Options, Tips and traps, Trustee

Whenever there is a discussion on Self-Managed Super nowadays, at some point the topic of cost will work its way into the conversation. Should I setup a SMSF – what will it cost compared to a public fund, how much will it cost to setup, how much will it cost to...

by smsfoptions | Fri, Jul, 2014 | Boosting your Balance, Borrowing, Property, SMSF Options, Tips and traps, Trustee

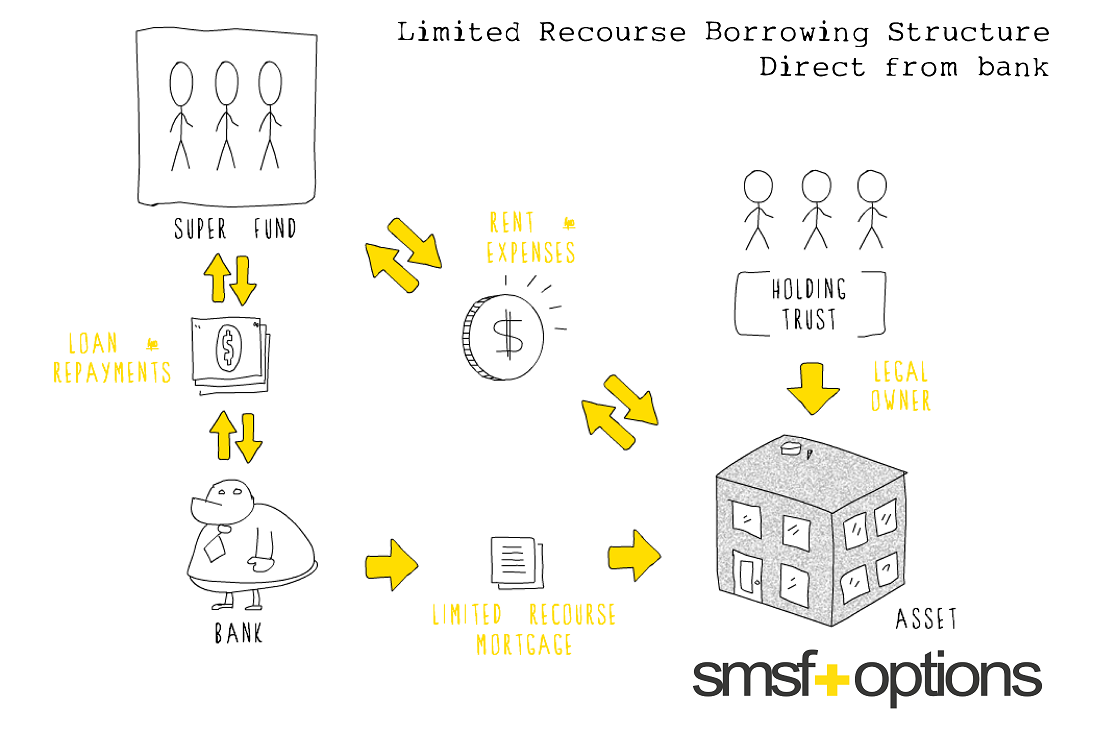

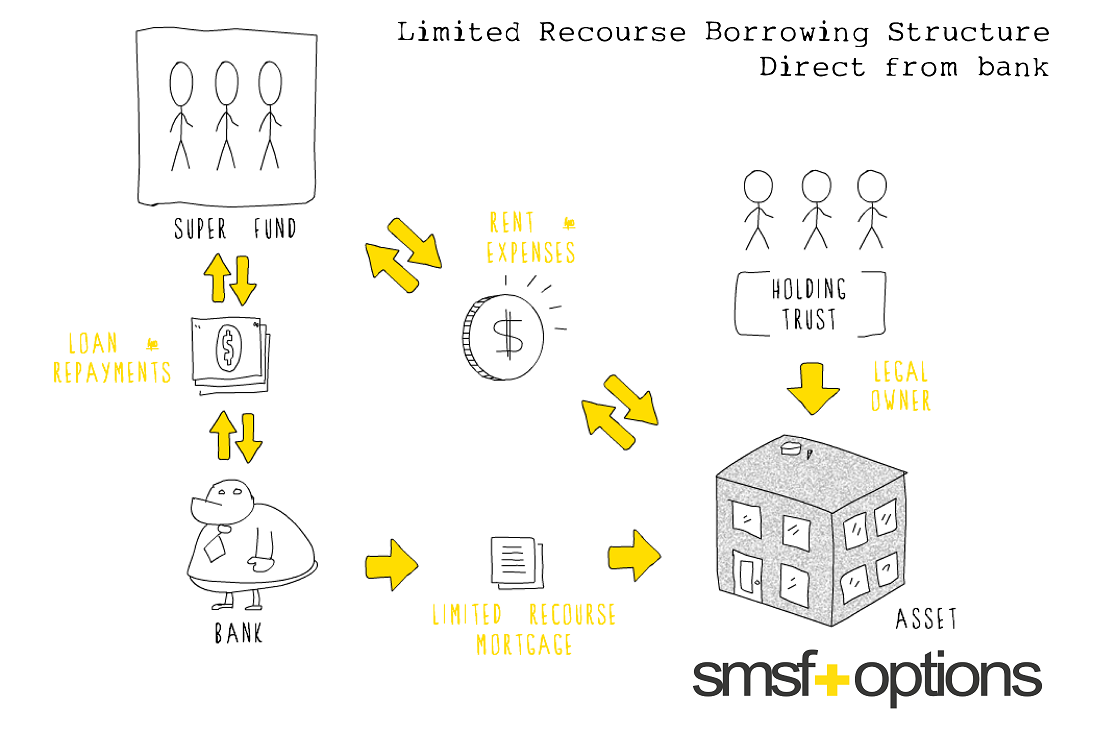

Although Self-Managed Superannuation Funds (SMSFs) are normally not allowed to borrow, there are some important exceptions to this rule. One such exception, which has received plenty of attention in recent times, is an “Limited Recourse Borrowing Arrangements” (LRBA),...

by smsfoptions | Mon, Jul, 2013 | Artwork & Collectables, Borrowing, Equities, Investments, Property, SMSF News, SMSF Options, Tips and traps

Earlier this year, the Government began moves to ban off-market transfers of assets to self-managed superannuation funds (SMSFs) from related parties. A related party of your SMSF broadly includes any other member of the SMSF, an employer that contributes to the fund...