Blog & Resources

Stay Up to Date!News

Property: alternatives to borrowing in super

It’s a common question. I would like to purchase property in my super fund; however my fund does not have sufficient money to finance the property. Are there any alternatives to borrowing in super? The simple answer is yes. While the merits of each alternative is...

How to setup your SMSF – The Key Steps

Sometimes just trying to understand where to start is the most difficult obstacle to overcome in any journey. The Self Managed Super journey is no different. With various setup options, investment choices and other matters it can be information overload. Here are some...

Access your super fund – anywhere, anytime

There is nothing more exiting than waking up by the pool while on holidays, than checking out your super fund's investments to see how they are going. Okay maybe not that exciting for most, but the great news you could do this if you wanted to, no matter the time, or...

10 Tips to reduce your SMSF administration costs

Whenever there is a discussion on Self-Managed Super nowadays, at some point the topic of cost will work its way into the conversation. Should I setup a SMSF – what will it cost compared to a public fund, how much will it cost to setup, how much will it cost to...

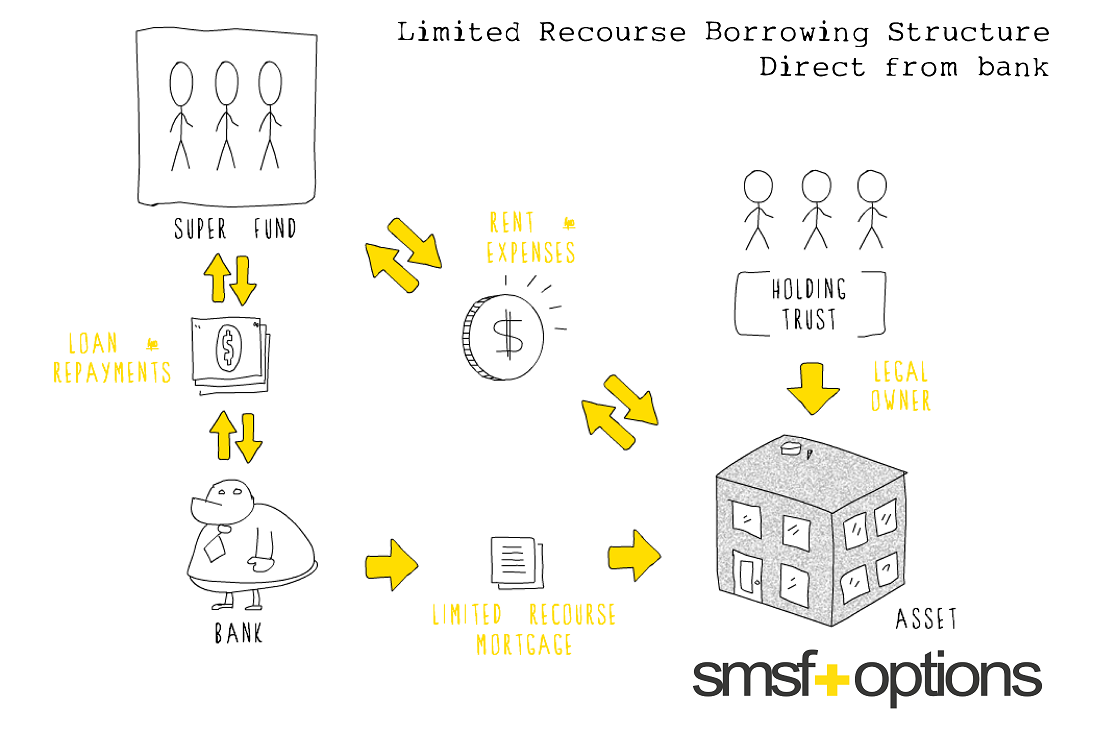

A Simple Guide to Borrowing in SMSF

Although Self-Managed Superannuation Funds (SMSFs) are normally not allowed to borrow, there are some important exceptions to this rule. One such exception, which has received plenty of attention in recent times, is an “Limited Recourse Borrowing Arrangements” (LRBA),...

New ATO Penalties for Self-Managed Super Funds

The ATO has introduced new penalty powers which it can impose on you if your fund breaks certain superannuation rules. The new rules apply from 1 July this year and allow the ATO to fine you and require you to rectify the mistake that has been made. They can also...

Government delivers tough 2014-15 Federal Budget

Refunds of excess non-concessional contributions, changes to the Super Guarantee and tighter rules on qualifying social security benefits were the main Budget announcements to impact on superannuation this year. These changes, along with others, should provide a...

Government Tax and Superannuation

On Wednesday 6 November 2013, the Treasurer, the Hon Joe Hockey MP, and the Assistant Treasurer, Senator the Hon Arthur Sinodinos AO, announced the Government’s decision to abandon some of the previous Government’s tax and superannuation proposals. The announcement...

Are all ‘Fund’ expenses tax deductible?

Have you recently seen advertising inviting you to attend a conference or seminar to educate you about self-managed superannuation funds (SMSFs)? Your SMSF pays for the privilege of attending the 'conference' in Australia or overseas and you take a holiday as well,...

Get a FREE eBook on How to buy property

in a SMSF (Coming soon…)

Subscribe

Office

- Currumbin – Gold Coast

AUSTRALIA

Contact Us

- hello@smsfoptions.com

(07) 5521 0029